Buy-to-Let

A buy-to-let mortgage is a loan for property investors, it differs from a residential homeowner mortgage because the lender requires the property to be rented to a tenant. A mortgage of this type can be secured against a single property, or across a portfolio of several properties.

Anyone who wants to rent out their former family home is required to take out a buy-to-let mortgage in place of a residential mortgage they may have. Failing to do so is a breach of their mortgage agreement - and may also invalidate their insurance policies.

Buy-to-Let Individuals

Whether you are a first time landlord or a seasoned property investor, Homequest Mortgages will advise your on the mortgage products most suitable for your situation.

We cover:

Buy-to-Let for Business

Corporate or company buy-to-lets will normally arrange the purchase of residential property through a limited company, or special purpose vehicle (SPV).

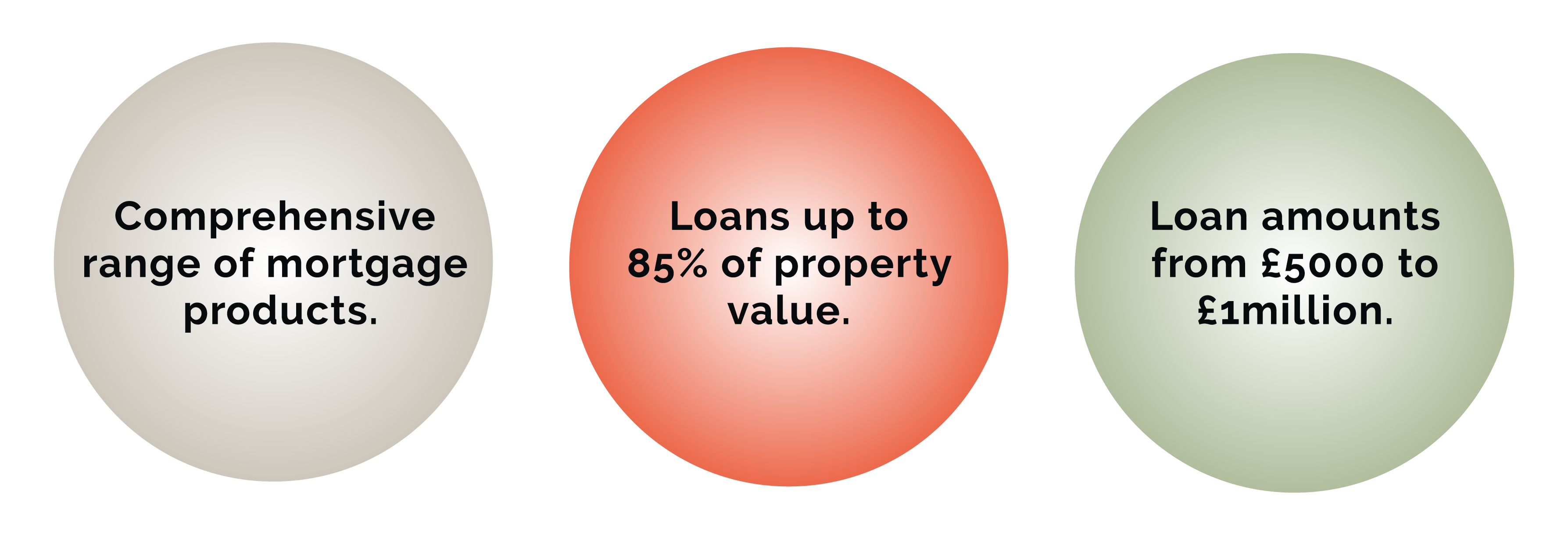

Homequest Mortgages has access to a comprehensive range of mortgage products and can arrange suitable buy-to-let lending choices for:

A mortgage is a loan secured against your property. Your property may be repossessed if you do not keep up repayments on your mortgage or any debt secured on it.

The Financial Authority does not regulate most forms of buy-to-let mortgages.